Employer of record in Morocco

Employer of record in Morocco

Employer of record in Morocco

Employer of record in Morocco

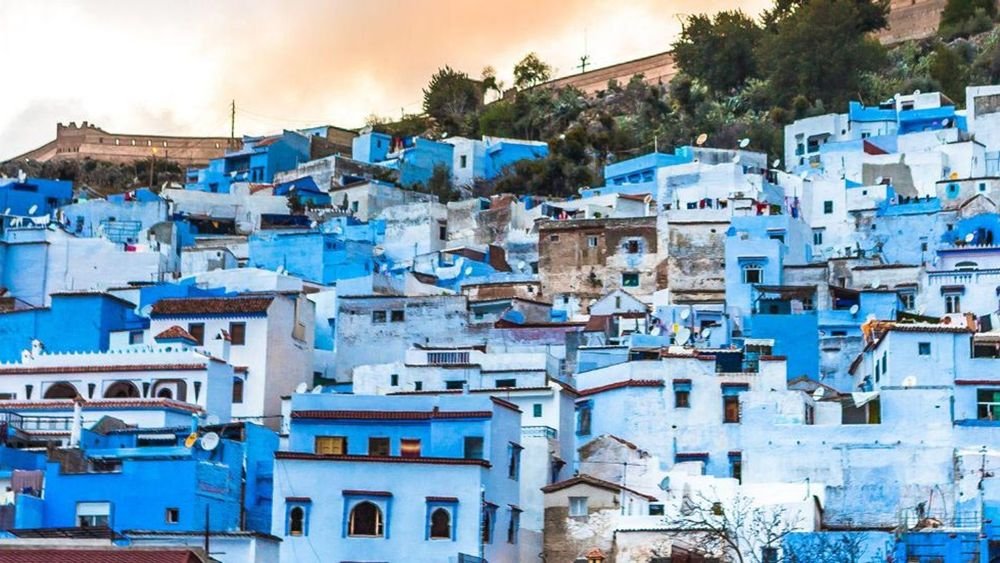

Morocco is a country located in North Africa, bordered by the Atlantic Ocean and Mediterranean Sea to the west and north, Algeria to the east, and Western Sahara to the south. Its capital is Rabat, and its largest city is Casablanca. Known for its rich history, diverse culture, and beautiful landscapes, Morocco features a mix of mountain ranges, desert terrain, and coastal areas. The country has a constitutional monarchy, with a king as the head of state, and is recognized for its historical cities, like Marrakesh and Fez, as well as its influence in the Arab world and beyond.

Employee Benefits

PAID TIME OFF

Annual Vacation: Employees are entitled to a maximum of 18 days of paid leave annually. After six months of continuous employment with the same employer, employees earn 1.5 days of leave for every month worked. This benefit increases by 1.5 days for every five years of service, with a cap of 30 calendar days. Upon termination, employees who have worked for at least six months are entitled to compensation for unused annual leave.

Sick Leave: Employees may not be absent for more than four days due to illness or injury without providing a medical certificate. A certificate is required if the absence exceeds four days. Employees may be deemed to have resigned if their absence exceeds 180 consecutive days. Sick leave benefits are provided by the National Social Security Fund (CNSS).

Maternity Leave: Pregnant employees are entitled to 14 weeks of maternity leave with a medical certificate. The terms may be more favorable based on the contract, collective agreement, or internal regulations. Employees are not permitted to work for 7 weeks post-childbirth. If necessary, maternity leave can be extended due to pregnancy-related conditions, up to 8 weeks before and 14 weeks after childbirth. Employees with at least 54 days of social security contributions in the past 10 months are eligible for maternity benefits, which are paid at 100% of their average wage for 14 weeks.

Paternity Leave: Employees are granted 3 paid paternity leave days, which do not need to be taken consecutively but must be used within a month of the birth.

Family Leave: Bereavement leave of up to 3 days is allowed.

National Holidays: There are 13 official holidays each year.

Other Paid Time Off

- Union Representative Leave: Unpaid leave for municipal council meetings unless otherwise agreed upon.

- Special Leave for Muslim Employees: Unpaid leave for Hajj, up to 30 days.

STATUTORY EMPLOYEE BENEFITS

Unemployment: Unemployment benefits are provided by CNSS and can be claimed for up to six months after job loss.

Workers’ Compensation: Employers are responsible for the total cost of workers’ compensation. Injuries or diseases must be evaluated, and the employee must provide a medical certificate.

Social Security: Social security is managed by CNSS. The monthly CNSS contributions are as follows:

- Professional Training Tax: Employers – 1.6%

- Family Benefits: Employers – 6.4%

- Employment Loss: Employers – 0.38%, Employees – 0.19% (capped at MAD 6000)

- Short-Term Social Benefits: Employers – 0.67%, Employees – 0.33% (capped at MAD 6000)

- Long-Term Social Benefits: Employers – 7.93%, Employees – 3.96% (capped at MAD 6000)

- Mandatory Health Insurance: Employers – 4.11%, Employees – 2.26%

Retirement: Retirement benefits are covered under the CNSS’s long-term social benefits.

Health: Health coverage is included under CNSS contributions. Employees must contribute a portion of their wages, while employers are also required to provide health insurance.

PRIVATE EMPLOYEE BENEFITS

- Workers’ Compensation: Private workers’ compensation is available.

- Retirement: Private retirement plans are available.

- Health: Private health insurance options are available.

- Insurance: Private life insurance is available.

PERSONAL INCOME TAX

Tax Year

The tax year in Morocco runs from January 1 to December 31.

Tax Rates

- 0 to 30,000 MAD: Exempt

- 30,001 to 50,000 MAD: 10%

- 50,001 to 60,000 MAD: 20%

- 60,001 to 80,000 MAD: 30%

- 80,001 to 180,000 MAD: 34%

- Over 180,000 MAD: 38%

Taxation Method: Morocco uses a progressive tax system.

Double Taxation: Morocco has agreements with various countries to avoid double taxation.

Residence Requirements: Tax residents in Morocco are those who have a habitual residence there, whose economic interests are in Morocco, or who spend more than 183 days in Morocco within a 365-day period. Tax residents are taxed on worldwide income, while non-residents are taxed only on Moroccan income.

Payroll Calendar: Payroll is processed monthly.

Rebates & Tax Credits: Taxpayers can deduct charitable contributions, professional expenses, and pension insurance contributions.

Health Insurance: All employees are legally required to have health insurance, with contributions from both the employee and employer.

PAYROLL ELEMENTS

Income

Income tax applies to:

- Salary

- Professional revenues

- Agricultural farm revenues

- Real estate income and capital gains

- Investment income

Bonuses: Although there are no legal requirements for bonuses, a 13th-month bonus is commonly paid.

Allowances: Common allowances include:

- Housing

- Transportation

- Education

- Meals

Benefits in Kind: These benefits are considered taxable income and must be reported based on their market value.

Retirement Funding: Retirement contributions are covered under long-term social benefits provided by CNSS.

Risk Insurance: Risk insurance is not a legal requirement but may be offered by employers as a benefit.

PAYROLL TAXES AND EMPLOYER CONTRIBUTIONS

Payroll Taxes: Employers are responsible for withholding tax and social security contributions from employees’ salaries and remitting them to the government.

Unemployment: CNSS provides unemployment benefits for up to six months, with eligibility requirements including a minimum number of days contributed.

Social Security Contributions: Social security contributions are shared between employers and employees, with the following contributions:

- Professional Training Tax: Employers – 1.6%

- Family Benefits: Employers – 6.4%

- Employment Loss: Employers – 0.38%, Employees – 0.19% (capped at MAD 6000)

- Short-Term Social Benefits: Employers – 0.67%, Employees – 0.33% (capped at MAD 6000)

- Long-Term Social Benefits: Employers – 7.93%, Employees – 3.96% (capped at MAD 6000)

- Mandatory Health Insurance: Employers – 4.11%, Employees – 2.26%

Workers’ Compensation: Employers cover all workers’ compensation costs, and employees must provide medical documentation for occupational injuries or diseases.

ADMINISTRATION

Employers are responsible for withholding taxes and social security contributions and submitting them to the government. Social security coverage includes old-age pensions, disability, and survivor benefits, and temporary disability benefits for injuries.