Nigeria’s 2026 Tax Reform: New Rates, Penalties & Compliance Guide for Employers and Individuals

Nigeria 2026 Tax Reform: New Rates, Penalties, and the Full Compliance Guide

Nigeria 2026 tax reform marks a turning point in the country’s fiscal landscape, reshaping compliance, enforcement, and relief measures for businesses and individuals alike. To set this transformation in motion, on June 26, 2025, President Bola Ahmed Tinubu signed four groundbreaking tax reform bills into law, laying the foundation for the most ambitious overhaul of Nigeria’s tax system in decades. These reforms fundamentally reshape how Nigeria collects revenue, with full implementation beginning on January 1, 2026.

What the New Tax Law Entails

The 2025 reform package comprises four Acts that work together: the Nigeria Tax Act (NTA), the Nigeria Tax Administration Act (NTAA), the Nigeria Revenue Service (Establishment) Act, and the Joint Revenue Board (Establishment) Act. These laws repeal and replace the Personal Income Tax Act, Companies Income Tax Act, Value Added Tax Act, Capital Gains Tax Act, Petroleum Profits Tax Act, and Stamp Duties Act—essentially rebooting Nigeria’s entire tax framework.

The Federal Inland Revenue Service (FIRS) will transition into the Nigeria Revenue Service (NRS), equipped with AI-driven tools to detect underreporting and cross-reference data across bank accounts, payroll systems, and business filings. The Joint Tax Board has already rebranded as the Joint Revenue Board, coordinating federal and state tax collection with harmonized systems set to launch in January 2026.

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, told Punch that the reforms target “the elimination of several taxes, multiple taxation, and illegal levies which continue to inflate the cost of transporting goods in our country.” He emphasized that officially, businesses pay over 60 taxes and levies—but unofficially, that number exceeds 200. The new system aims to reduce this to single digits.

Nigeria’s 2026 Tax Reform: Who Is Impacted

Nearly every economic actor in Nigeria feels the ripple effects of this reform:

Individuals earning income face a completely revised personal income tax structure with new bands, reliefs, and a tax-free threshold raised to ₦800,000 annually. Employees, freelancers, and remote workers are all in scope.

Remote workers and freelancers working for foreign companies must now register with the NRS, self-declare their annual income, and pay tax (up to 23%) on global earnings if they’re Nigerian residents—even if paid offshore. This closes a long-standing loophole.

Small businesses with turnover below ₦50 million and fixed assets under ₦250 million are fully exempt from Companies Income Tax, Capital Gains Tax, and the new 4% Development Levy.

Large corporations and multinationals face a minimum 15% Effective Tax Rate (ETR), aligned with the OECD’s global tax framework, plus the 4% Development Levy replacing fragmented sectoral charges.

Foreign employers hiring Nigerians must navigate new permanent establishment and significant economic presence rules, plus stricter withholding tax obligations on payments to non-residents.

Non-residents are taxed only on Nigerian-sourced income, with clearer residency definitions based on the 183-day rule.

Key Tax System Overhaul in Nigeria's Tax Law 2026

Personal Income Tax: Progressive Bands and Expanded Relief

Expanded Relief

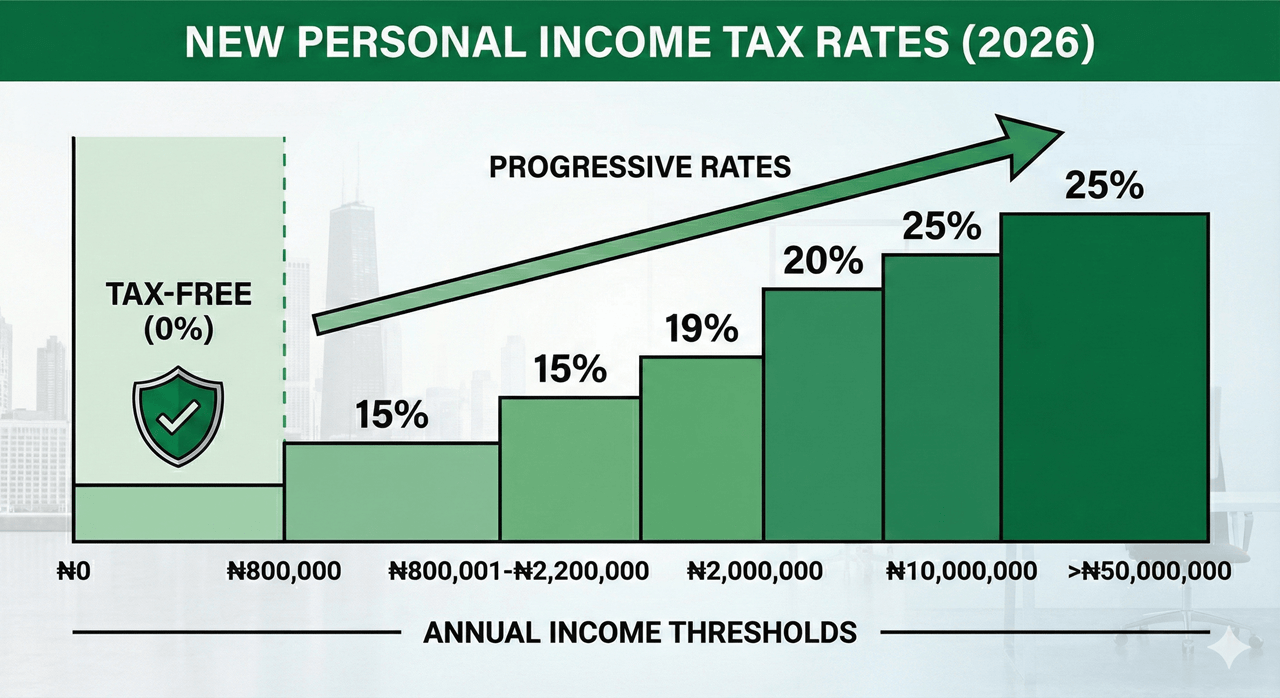

The new personal income tax rates, effective January 1, 2026, introduce a more progressive structure:

Annual Income Range (₦) | Tax Rate |

First 800,000 | 0% (Tax-Free) |

Next 2,200,000 (800,001 – 3,000,000) | 15% |

Next 9,000,000 (3,000,001 – 12,000,000) | 18% |

Next 13,000,000 (12,000,001 – 25,000,000) | 21% |

Next 25,000,000 (25,000,001 – 50,000,000) | 23% |

Above 50,000,000 | 25% |

This structure means individuals earning the minimum wage or up to ₦1.2 million annually pay zero tax—up from the previous ₦300,000 threshold. The maximum rate of 25% applies only to ultra-high earners, making Nigeria’s top rate lower than South Africa (45%), Kenya (35%), and Egypt (27.5%).

Allowable deductions before calculating chargeable income include pension contributions (8% of gross), National Housing Fund (2.5%), life assurance premiums (up to ₦100,000), and a new rent relief of 20% of gross income, capped at ₦500,000. This replaces the old consolidated relief allowance system.

Companies’ Income Tax: Small Business Exemption and Rate Stability

Corporate income tax remains at 30% for standard companies, but small companies—defined as those with annual turnover not exceeding ₦50 million and fixed assets below ₦250 million—are taxed at 0%. This threshold has doubled from the previous ₦25 million turnover limit, expanding relief to more micro and small enterprises.

Professional service providers (lawyers, accountants, consultants) are explicitly excluded from the small company exemption, regardless of their revenue.

The 4% Consolidated Development Levy

This replaces four separate levies: Tertiary Education Tax (3%), NITDA Levy (1%), NASENI Levy (0.25%), and Police Trust Fund Levy (0.005%)—totaling 4.255% under the old system. The new unified 4% levy on assessable profits simplifies compliance, reduces administrative burden, and funds education, student loans, technology, and security.

Small companies and non-resident companies are exempt from this levy.

Value Added Tax: Zero-Rating Essentials

VAT remains at 7.5%, but the list of zero-rated and exempt items has expanded significantly:

Zero-rated (0% VAT):

- Basic food items

- Educational materials and services

- Health and medical services

- Pharmaceutical products

- Non-oil exports

- Books

Exempt from VAT:

- Rent

- Public transportation

- Renewable energy

“These categories constitute about 82% of household consumption and nearly 100% for low-income households, directly addressing cost-of-living pressures,” says Taiwo Oyedele.

Penalties and Enforcement: The Era of "Zero Tolerance"

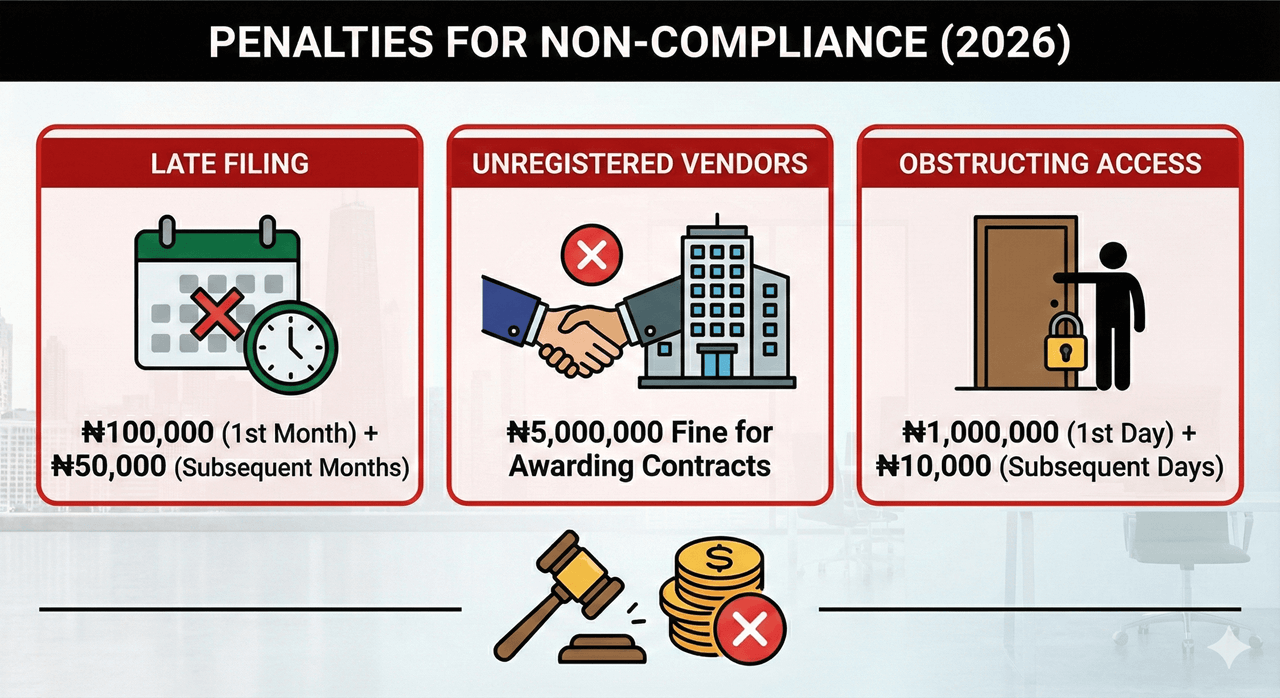

The new Nigeria Tax Administration Act doesn’t just ask nicely; it asks for firm compliance. The penalties for non-compliance have been stiffened significantly to deter evasion and “creative accounting.” Here are the specific consequences you need to know to stay out of trouble (and out of jail):

Failure to Deduct Tax: If you are required to withhold tax (like PAYE or Withholding Tax) and fail to do so, you will pay a penalty of 40% of the amount not deducted. That’s almost half the tax itself, gone in fines.

Failure to File Returns: Missing the filing deadline isn’t a minor oversight anymore. It attracts a penalty of ₦100,000 for the first month and ₦50,000 for every subsequent month the failure continues.

Failure to Remit Tax: If you deduct tax but don’t pay it to the government, you face a 10% per annum administrative penalty plus interest at the CBN rate. Even worse, if convicted, you could face imprisonment for up to 3 years.

Bribery and Inducement: Trying to bribe your way out of trouble? Think again. The penalty for inducing a tax officer is ₦500,000 for individuals and a staggering ₦2,000,000 for corporate bodies. You could also face up to 3 years in jail.

Obstruction with Arms: This is the most severe warning. If you obstruct a tax officer while armed with a weapon, you risk up to 5 years in prison. If you injure the officer, that jail term doubles to 10 years.

Vendor Compliance: Companies that award contracts to unregistered vendors (those without a TIN) face a massive ₦5 million penalty.

The message is loud and clear: the cost of non-compliance is far higher than the cost of paying your fair share.

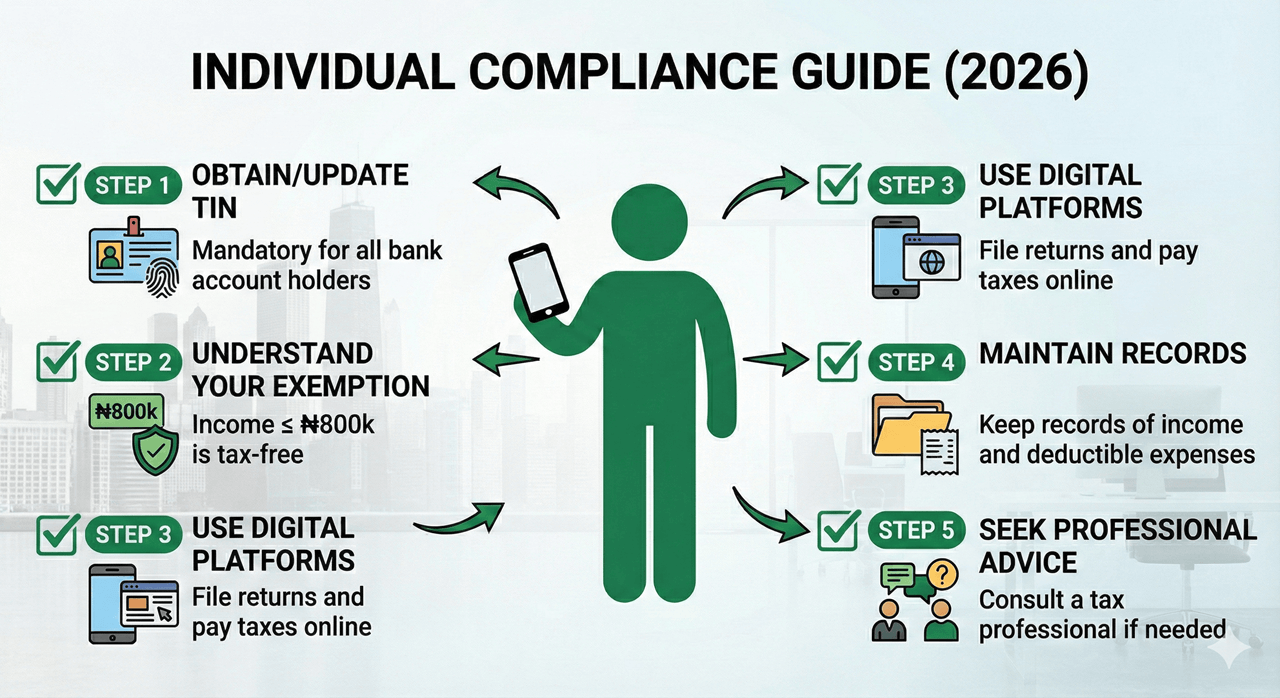

Requirements to Stay Compliant: Who Needs a Tax ID

The Nigeria Tax Administration Act mandates that all taxable persons must register with the relevant tax authority and obtain a Tax Identification Number (TIN) by January 1, 2026.

Who is a “taxable person”? Anyone earning income through trade, business, or any economic activity—including employees, freelancers, remote workers, and businesses.

Who is exempt? Students, dependents, and individuals with no taxable income do not need to obtain a TIN to open bank accounts or conduct personal transactions. factcheck.thecable+2

Taiwo Oyedele clarified in an interview shared on his X account: “Banks must request a tax ID from taxable persons. This means that individuals who do not earn an income, such as students and dependents, do not need to obtain a tax ID.”

How TIN Works

For individuals, the TIN is linked to your National Identification Number (NIN). For businesses, it’s tied to your Corporate Affairs Commission (CAC) registration number. The system automatically generates TINs, so most people will not need to apply separately; banks and institutions will retrieve it via NIN or RC number during KYC processes.

However, taxable persons without a TIN may face restrictions on bank accounts, insurance policies, pension accounts, investment accounts, and government contracts starting January 2026.

Tax Calculations and Rules: Companies, Individuals, Remote Workers, Residents, SMEs

Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

Individual PAYE Calculation Example

Let’s calculate PAYE for an employee earning ₦300,000 monthly (₦3.6 million annually) with annual rent of ₦600,000:

Step 1: Calculate Deductions

- Pension (8%): ₦288,000

- NHF (2.5%): ₦90,000

- Rent Relief (20% of gross, capped at ₦500,000): ₦500,000

- Total Deductions: ₦878,000

Step 2: Chargeable Income

- Gross: ₦3,600,000

- Less Deductions: ₦878,000

- Chargeable Income: ₦2,722,000

Step 3: Apply Tax Bands

- First ₦800,000 @ 0%: ₦0

- Next ₦1,922,000 @ 15%: ₦288,300

- Total Annual PAYE: ₦288,300

- Monthly PAYE: ₦24,025

Remote Workers: Tax on Foreign Income

A Nigerian resident earning $2,000 monthly (approximately ₦2.98 million monthly, or ₦35.72 million annually) from a US-based remote job pays roughly 23% tax (₦684,599 monthly) after deductions.

The law explicitly states: “The income, gains or profits of an individual who is a resident of Nigeria are deemed to accrue in Nigeria and are chargeable to tax in Nigeria wherever they arise, and whether or not the income, profits or gains have been brought into or received in Nigeria.”

Relief from Double Taxation: Nigeria has Double Taxation Treaties (DTTs) with 15 countries, including the UK, Canada, China, France, and South Africa. Tax paid abroad can be credited against Nigerian tax liability. Where no DTT exists, the law provides unilateral relief to prevent the same income being taxed twice.

Residents vs. Non-Residents

Residents are taxed on their worldwide income. Residency is determined by the 183-day rule—cumulative days of physical presence in Nigeria within a 12-month period.

Non-residents are taxed only on Nigerian-sourced income (e.g., rental income, dividends, business profits from Nigerian operations), using the same progressive rates as residents.

Small Companies: 0% Tax Rate

If your company has:

- Annual turnover ≤ ₦50 million, AND

- Total fixed assets ≤ ₦250 million, AND

- Is not a professional service provider,

You qualify for 0% Companies Income Tax, 0% Capital Gains Tax, exemption from the 4% Development Levy, and exemption from withholding tax (if monthly transactions are below ₦2 million and you hold a valid TIN).

However, you must still file annual returns with the NRS, even if your tax liability is zero.

The Tax Law Implications for Foreign Employers

Foreign companies operating in or hiring from Nigeria must adapt quickly:

- Expanded Taxable Presence: Digital platforms, remote service providers, and companies earning income from Nigeria may trigger Permanent Establishment or Significant Economic Presence, subjecting them to Nigerian corporate tax.

- Shadow Payroll for Remote Employees: If you pay Nigerian residents from abroad for work performed in Nigeria, you must calculate and remit Nigerian PAYE—even if the employee never receives funds in Nigeria.

- Withholding Obligations: Payments to non-residents for services, royalties, or technical fees trigger withholding tax obligations for the Nigerian payer (typically 10%).

- Stricter Compliance and Penalties: The NRS will use data analytics to cross-check payroll, bank transactions, and tax filings. Late filing attracts ₦100,000 in the first month, then ₦50,000 monthly. False declarations can result in fines up to ₦1 million or three years in prison, or both.

Offense | Initial Penalty | Subsequent Penalty (Monthly) | Criminal Sanction (Upon Conviction) |

Failure to File Tax Returns | ₦100,000 (First Month) | ₦50,000 (Each Subsequent Month) | N/A (Administrative Penalty) |

Submitting False/Misleading Documents | ₦1,000,000 (Administrative) | N/A | Fine up to ₦1,000,000 or Imprisonment up to 3 years, or both. |

- Controlled Foreign Corporation Rules: Nigerian parent companies must declare and pay tax on profits retained in foreign subsidiaries if those profits could be distributed.

How to Stay Compliant Within the Short Timeframe: Using EOR Like Remote Solutions Africa

Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

The January 1, 2026 deadline is tight. For foreign companies without local entities or expertise, Employer of Record (EOR) services offer the fastest, most compliant path to hiring and paying staff and staying ahead of the strict penalties accompanying Nigeria’s 2026 Tax Reform.

What is an EOR?

An EOR becomes the legal employer of your Nigerian staff, assuming full responsibility for employment contracts, payroll processing, tax withholding and remittance, statutory benefits, and labor law compliance—while you retain operational control over day-to-day work.

Remote Solutions Africa is a leading Africa-focused EOR provider with operational coverage across East, West, and Southern Africa, including Nigeria. We provide:

• Compliant employment contracts aligned with Nigerian labor law and the new tax framework

• Real-time payroll assistance, including accurate PAYE calculations under the 2026 tax bands

• TIN registration and validation for all employees

• Statutory remittances (pension, NHF, NHIS, PAYE) handled on time, every time

• Locally fluent support with nuanced insight into regulatory changes and workflows

• Risk mitigation by assuming legal employer responsibilities, shielding foreign companies from penalties

• Work permit and immigration services

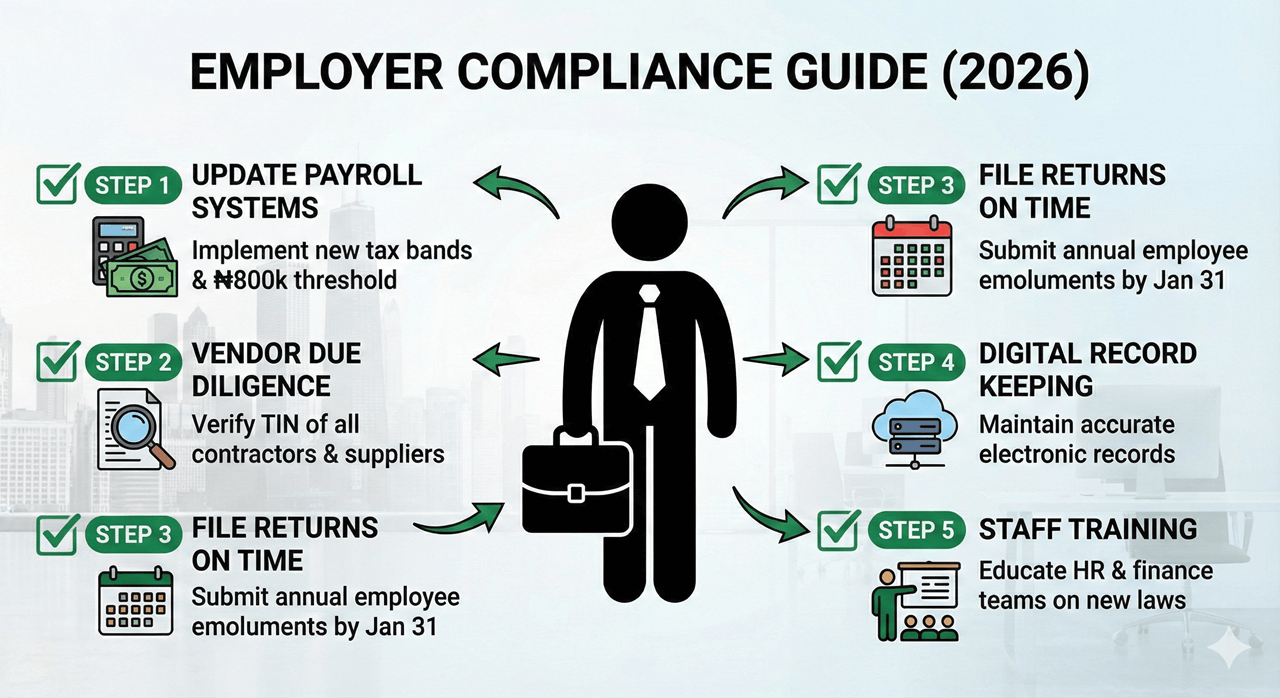

Why EOR Matters Now: Meeting the Demands of Nigeria 2026 Tax Reform

• Updated payroll systems reflecting new tax bands, reliefs, and deductions

• Accurate TIN validation for all employees and vendors

• Digital-first filing with the NRS via e-invoicing and real-time VAT systems

• Stronger documentation and audit readiness, as the NRS cross-references payroll, bank data, and tax filings

• Vendor compliance checks to avoid the ₦5 million penalty for engaging unregistered contractors

EOR providers like Remote Solutions Africa have already updated their systems to reflect all 2025 reforms, ensuring clients remain compliant from day one without manual calculations or risk of error.

For companies hiring remotely or expanding into Nigeria, partnering with an EOR is not just convenient—it’s a strategic hedge against the steep penalties, digital enforcement, and data-driven audits that define Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

Nigeria 2026 Tax Reform

Conclusion

Nigeria 2026 tax reform overhaul represents the most ambitious fiscal reform in decades. The system rewards small businesses and low earners with unprecedented relief, while tightening enforcement on large corporations, multinationals, and previously untracked digital earners. The transition to digital administration, unified levies, and stricter penalties signals a fundamental shift: the era of informal, under-the-radar earning is ending.

For global employers, the message is clear: compliance is no longer optional, and ignorance carries real costs. Whether you’re hiring your first Nigerian employee or managing a regional team, the tools and partners you choose now—payroll systems, EOR providers, and compliance advisors—will determine whether January 2026 brings smooth operations or costly disruptions under Nigeria’s 2026 Tax Reform.

As Taiwo Oyedele emphasized, the reforms are “focused on the people,” designed to “protect vulnerable income earners and very small businesses” while ensuring “payment and collection of taxes are being taken seriously.” The question is no longer whether to comply, but how quickly you can adapt.